08 Mar Nevada Registration Fees Explained

Each year it happens whether we like it or not, registration fees must be paid to the Nevada DMV. Each state has different fees when it comes to automobile registration and Nevada’s fees are on the higher end of the spectrum. While the actual registration fee is $33, government taxes can add a significant amount to that number.

The basics:

Nevada registration fees are based on 35% of the original MSRP. Essentially that ridiculously high sticker price on a new car. Let’s take a 2022 Honda Accord with an MSRP of $38K. Since 35% of $38K is $13,300, the DMV will use that number to calculate registration fees.

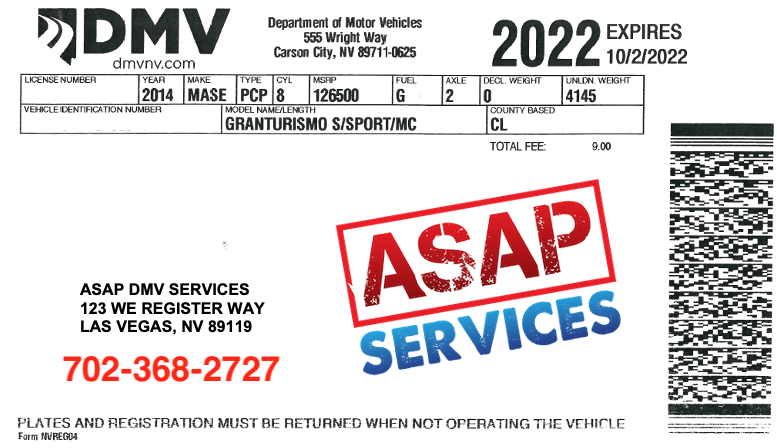

For those of you who have a NV registration Card you will see the MSRP in the top section of the registration card. ( See image below)

You can find the official Nevada DMV Registration Estimator Here

How to calculate fees

Governmental Services Tax is 4 cents on each $1 of the depreciated MSRP.

Supplemental Governmental Services Tax 1 cent on each $1 of the depreciated MSRP.

$13,300 x .04 = $532 &. $13,300 x .01 = $133. The two taxes together are $665 which is a good estimate of what the registration fees would be given this example. There are other fees such as the $33 base registration fee. However, 98% of the registration fees are made up of the two taxes.

Both taxes are added to the registration fees each year. THIS IS NOT SALES TAX. People often confuse these fees as sales tax. The taxes are fees the state collects to support public services such as schools and road improvement.s

The good news is that each year the MSRP value is depreciated which means the annual registration fees go down. Specialty and vanity plates have additional fees. The above example is for illustration purposes only and actual fees may vary.

You can find the official Nevada DMV Registration Estimator Here

If you have any questions about registration or license plate fees please give us a call @ 702-368-2727 or head over to the Live Chat.

ASAP services provides Nevada DMV Services specializing in Titling and Auto registration.

Check out our registration fee calculator & depreciation schedule.

Sorry, the comment form is closed at this time.